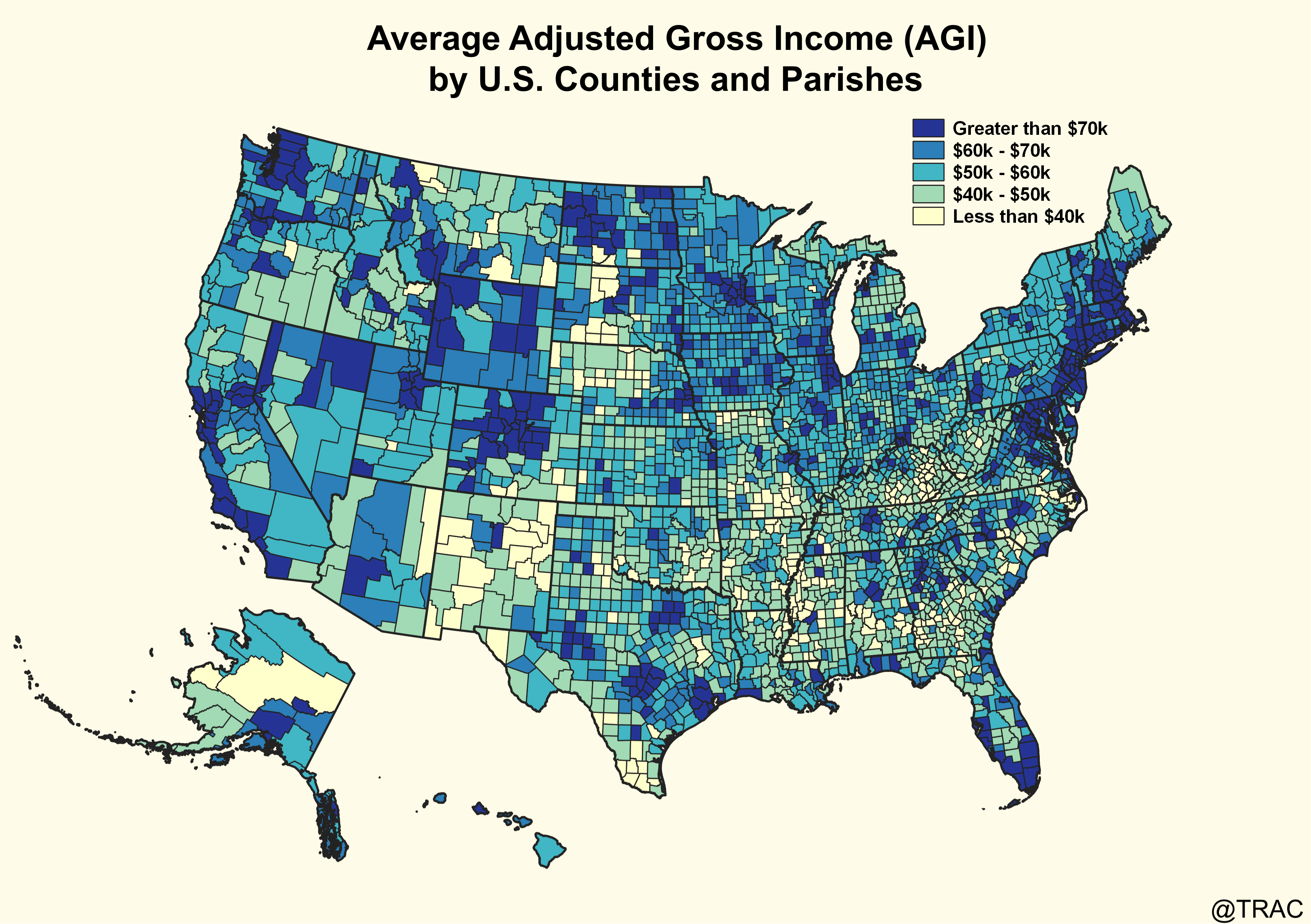

Mapping IRS Tax Return Filings Reveals Marked Differences in the Distribution of Income and Dependents

2023-04-27 Latest figures on reported income on federal income returns varied markedly across states and counties. Massachusetts had the highest average reported income, followed by Connecticut and Washington State. The lowest with only half that of the top three states was Mississippi. West Virginia and New Mexico returns.

IRS Audits Few Millionaires But Targeted Many Low-Income Families in FY 2022

2023-01-04 While the 2022 Inflation Reduction Act

provides the IRS with a large expansion of future funding to beef up audits of the rich, last year

IRS revenue agents were only able to audit a small number of millionaire returns Ð just one out of

every hundred -- lower than the effective audit rate for the lowest income wage-earners.

IRS Continues Targeting Poorest Families for More Tax Audits During FY 2022

2022-03-29 Internal Revenue Service Commissioner

in state of denial over latest IRS statistics revealing that the agency is continuing to target

audits on the poorest wage earners. Audit numbers for these low-income wage earners with less than

$25,000 in total gross receipts increased compared to a year ago.

IRS Audits Poorest Families at Five Times the Rate for Everyone Else

2022-03-08 Last year in FY 2021, the IRS audited

just 4 out of every 1,000 returns filed (0.4%). Audit rates in general have been dropping for many

years.

Millionaires and Corporate Giants Escape IRS Audits Again in FY 2020

2021-03-18 At a time of growing economic

inequality and financial hardship caused by the COVID-19 pandemic, the federal government is

letting billions of dollars in tax revenue slip through its fingers because budget and staffing

cuts have left the IRS incapable of auditing the 637,212 millionaires now living in the United

States.

Is Your Income Higher Now Than 10 Years Ago? It Depends On Where You Live

2020-04-15 Where you reside has had a major

impact on the relative change in prosperity families experience. Some counties saw a doubling of

average adjusted gross incomes while taxpayers in other counties experienced declines.

Federal Civil Tax Suits Fall by Half Over Last Decade

2020-01-22 Federal civil tax suits filed during

the first quarter of FY 2020 continue to fall. Over half of the suits filed by taxpayers were

suits for refunds of taxes or penalties.

Millionaires and Corporate Giants Escaped IRS Audits in FY 2018

2019-03-07 The latest alarming data reveal that

97 out of every 100 taxpayers reporting over a million dollars of income were not audited last

year. And for these millionaires the puny number of IRS audits has been cut in half since 2010

Nearly Half of Corporate Giants Escape IRS Audit in 2017

2018-04-09 Almost half of the 616 largest

corporations in the country - those with over $20 billion in assets - were not even audited by the

IRS last year. While the number of corporate giants are increasing, the actual number that are

audited has steadily fallen.

Taxpayers Referred for Criminal Prosecution by IRS Reach New Low

2018-03-26 Data now show that the number of IRS

referrals for criminal prosecution are down substantially from their peak four years ago when the

agency had referred more than twice the number.

IRS County Income

1991-12-31 - 2021-12-31

IRS Criminal Enforcement

2021-10-01 - 2022-09-30

Query Statutes

2022-10-01 - 2023-06-30

InfoGraph

The decrease from the levels five years ago in immigration prosecutions for these matters is shown more clearly in this figure. The vertical bars in Figure 1 represent the number of immigration prosecutions of this type recorded on a month-to-month basis. Where a prosecution was initially filed in U.S. Magistrate Court and then transferred to the U.S. District Court, the magistrate filing date was used since this provides an earlier indicator of actual trends.

more infographs

Reference Library

- Immigration Detention: Actions Needed to Collect Consistent Information for Segregated Housing Oversigh

- Southwest Border: CBP Oversees Short- Term Custody Standards, but Border Patrol Could Better Monitor Care of At-Risk Individuals

- Border Patrol Could Better Monitor Care

A reference library of reports on immigration matters produced by government agencies and offices

including the Government Accountability Office, the inspectors general of the agencies, the

Congressional Research Service, House and Senate committees, etc.

more references

Glossary

Random word: Asylee

A person who has been granted asylum status in the U.S. Asylees are given certain legal rights, such

as to be able to remain indefinitely in this country, to bring spouses and minor children to the

U.S. as asylees, and to work legally. They also are eligible for some public benefits and to apply

for lawful permanent residence (green card) after a one-year waiting period.

Plain English definitions of immigration terms and acronyms.

more glossaries